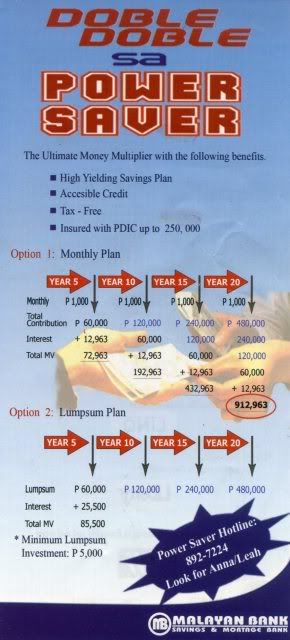

The first 5 years is the monthly savings stage. Once you open the power saver account, you deposit every month 1000 pesos for 5 years. This will then accumulate to 60,000 pesos. At that time, you can get the money with an total interest rate of P12,963 or you have the option not to take the amount and interest and leave it for another 5 years. On the 10th year, the 60,000 pesos will become 120T. Leave it for another 5 years and it will become 240T. Another extra 5 years it will be 480T. A total of 20 years.

What is good about this account is that you only save 1000 pesos every month for the first 5 years and still get P12,963 if you opted not to continue it. But if you do, then double your money in 5 years time is something that no other bank has given for quite a long time.

Again you have the option to continue adding 1000 pesos every month for another 5 years which of course will give you another set of double your money.

Now as for the risk, PDIC will cover you for 250,000 so that means you can keep your investment with them for 15 years and you are safely covered. The last 5 years then will be the risk you have to take since the amount is beyond the coverage. However that will be 15 years from now and with the recent push of changing the coverage amount to 500,000 pesos by the BSP and PDIC through the help of congress, then that may be covered too by that time.

Another Power Saver scheme is the 500 pesos per monthly plan. It is the same mechanics except that P500 instead of P1,000 will be deposited.

The picture below shows the options you can take.

What will happen if I was not able to deposit monthly?

If you are not able to deposit monthly for 3 months, the account will be converted to a regular savings account. If you were late in your monthly deposit, a penalty of 1% is given. If due to unavoidable circumstance, you wanted to withdraw from it, then it will again be converted to a regular savings account.

This can then be an investment alternative for those who want to retire or even as a legacy they can give to their love ones once the time comes for the investment to be taken out once it becomes due.

"Malayan bank was founded in 1996 and is a joint undertaking of outstanding business leaders coming from GMA Network, LINQ Corporation, Liberty Flour Mills, and the Majaco Group" taken verbatim in their website.

Their branches are found in Makati, Kalentong, Pasig, Marikina, Las Piñas, GMA Quezon City, Sta. Rosa Laguna and Imus Cavite. How to contact them and map can be found here.

hi there..about malayan bank, it is really good to invest to power saver plan because a lot of banks declared bankruptcy. a radio announcer said that we must be careful in banks saying they can double the money.

ReplyDeleteThanks anonymous for your comment.

ReplyDeleteIt is definitely prudent to invest wisely. One must realize that in investing, there are low, moderate and high risk. There is no such thing as no risk investment. Which is why a person should try to check and countercheck the reliability and validity of an investment vehicle. As presently seen in the worldwide financial crisis, even the oldest institutions fall.